Africa’s growth outlook from 2025 to 2028 paints a picture of resilience and transformation. Real GDP growth is forecast to rise from 3.9% in 2025 to 4.0% in 2026, reaching 4.2% in 2027 and 4.4% by 2028. This steady upward trend reflects reforms in fiscal management, deeper regional integration, and a surge in domestic capital mobilization.

But beyond macroeconomic stability, this growth wave is opening unprecedented opportunities for startups and entrepreneurs, who are increasingly positioned as the continent’s engines of innovation.

Regional Growth Forecasts: 2025 – 2028

Region 2025 2026 2027 (proj.) 2028 (proj.)

East Africa 5.9% 5.9% 5.8% 5.9%

West Africa 4.3% 4.3% 4.4% 4.5%

North Africa 3.6% 3.9% 4.0% 4.1%

Central Africa 3.2% 3.9% 3.8% 4.0%

Southern Africa 2.2% 2.5% 2.6% 2.7%

Africa (avg.) 3.9% 4.0% 4.2% 4.4%

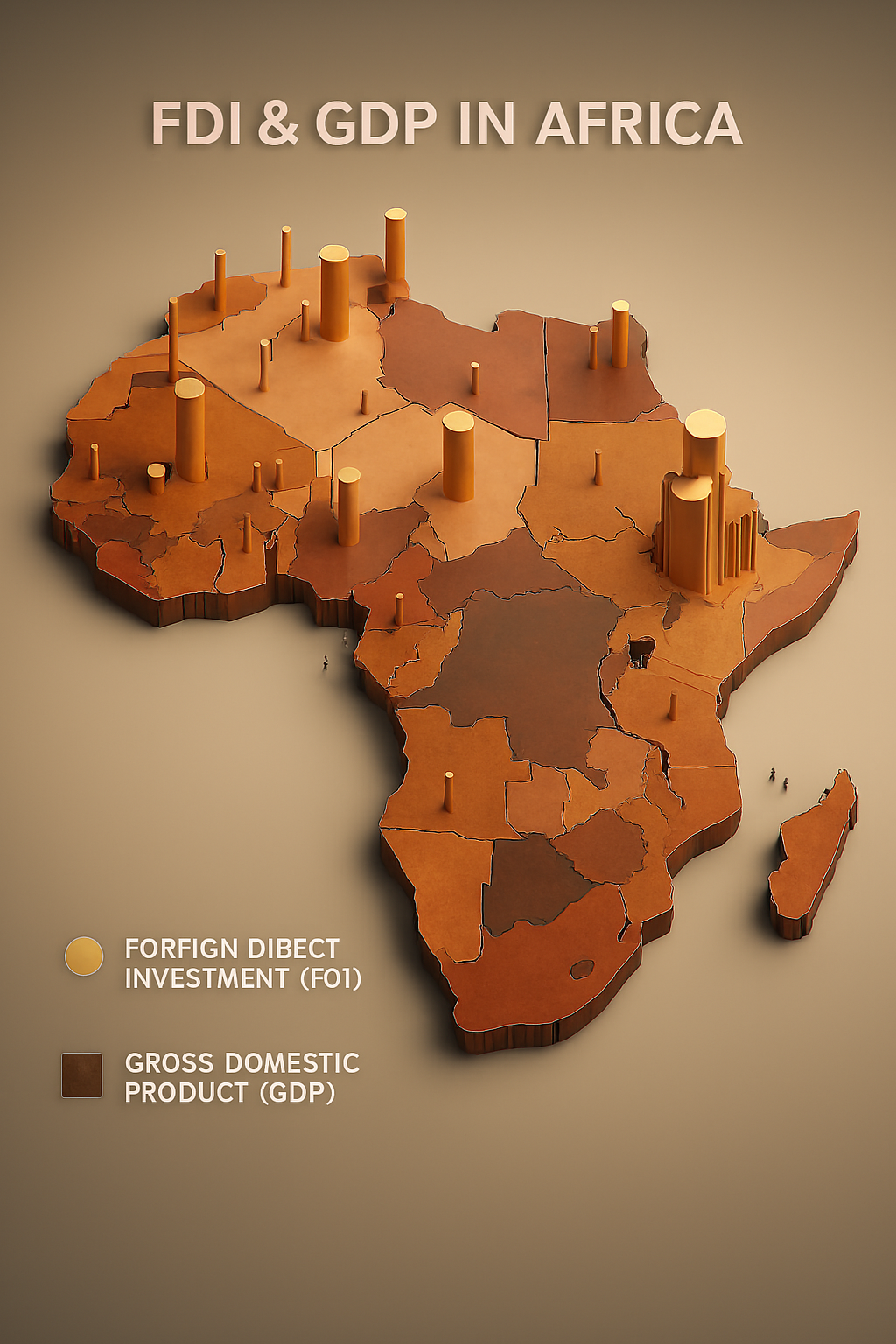

FDI Outlook: Who’s Investing in Africa?

Foreign Direct Investment (FDI) remains a critical driver of Africa’s transformation. While global flows have been volatile, Africa continues to attract strategic capital from key partners:

Top FDI Source Countries (2025–2028)

1. China – Infrastructure, mining, manufacturing, and digital platforms

2. United States – Energy, fintech, agribusiness, and health innovation

3. United Arab Emirates – Logistics, ports, real estate, and clean energy

4. France – Urban infrastructure, transport, and financial services

5. India – Pharmaceuticals, ICT, and agritech

6. Germany – Industrial automation, green energy, and vocational training

7. United Kingdom – Financial services, education, and climate finance

8. Saudi Arabia – Energy, tourism, and sovereign investment platforms

9. Japan – Automotive, electronics, and smart infrastructure

10. South Korea – Digital infrastructure, consumer goods, and education tech

These countries are not just investing; they’re partnering with Africa’s reformers and innovators.

Top 10 African Economies Poised to Benefit Most (2025–2028)

Country Why They Stand Out

- Senegal Oil & gas boom, stable governance, regional logistics hub

- Rwanda Tech-driven reforms, green finance, institutional strength

- Ethiopia Manufacturing growth, infrastructure scale-up, regional integration

- Uganda Energy investments, agri-value chains, regional trade

- Côte d’Ivoire Agro-processing, industrial zones, AfCFTA leadership

- Zambia Mining reform, debt restructuring, green minerals

- Tanzania Energy corridor, tourism rebound, diversified exports

- Benin Port modernization, fiscal discipline, digital governance

- Morocco Automotive exports, renewable energy, EU proximity

- Nigeria Large market, fintech ecosystem, oil sector reforms (conditional on execution)

- These economies combine reform momentum, strategic sectors, and investor confidence.

Strategic Imperatives for Sustained Growth

- Capitalize on AfCFTA: Deepen regional trade and industrial linkages

- Mobilize domestic capital: Unlock the projected $1.43 trillion in untapped resources

- Strengthen institutions: Improve legal predictability, transparency, and public financial management

- Accelerate infrastructure: Invest in energy, logistics, and digital connectivity

- Empower human capital: Align education and skills with emerging sectors

African Startups and Entrepreneurs: The Real Winners

Africa’s growth wave is not just about governments and multinationals, it is about entrepreneurs and startups who are uniquely positioned to capture new opportunities:

- Access to Capital: Rising FDI and domestic capital mobilization will expand venture funding, angel investment, and SME financing.

- Digital Transformation: With ICT and fintech at the forefront, startups can scale solutions in payments, e-commerce, and healthtech.

- Green Economy: Renewable energy and climate finance open doors for clean-tech innovators.

- Agri-Tech: Value addition in agriculture creates space for startups in logistics, processing, and smart farming.

- Regional Integration: AfCFTA reduces barriers, enabling startups to scale across borders and tap larger markets.

- Diaspora Engagement: Remittance securitization and diaspora bonds will channel resources into entrepreneurial ventures.

Strategic Imperatives for Entrepreneurs

Leverage AfCFTA: Build scalable businesses that serve regional markets.

Innovate in Fintech & Agri-Tech: Align with Africa’s strongest growth sectors.

Tap into Green Finance: Position startups in renewable energy, waste management, and sustainable agriculture.

Collaborate with Global Investors: Form partnerships with FDI players entering Africa’s markets.

Invest in Skills: Align workforce training with digital and industrial transformation.

Conclusion: Africa’s Investment Horizon Is Expanding

From Dakar to Dar es Salaam, Africa’s growth story is no longer just about resilience, it’s about readiness. With the right reforms, strategic partnerships, and visionary leadership, the continent is poised to turn forecasts into transformation.